Stu Morrow, CFA | Mawer Investment Counsellor

For decades, the investment world operated on a fundamental assumption: when equities falter, bonds provide stability. This relationship formed the bedrock of portfolio construction, with fixed income serving as the dependable counterweight to stock market volatility. Then came 2022—a year that upended conventional wisdom as both bonds and equities declined in tandem, leaving many investors questioning long-held beliefs about asset allocation.

This market behaviour serves as a powerful reminder that fixed income operates in cycles, with today's environment requiring different approaches than those that were successful in recent decades. The good news? With challenge comes opportunity—for those prepared to adapt.

This article, the second in our two-part series on fixed income investing, builds upon the fundamentals covered in Understanding Bond Investing: A Foundation for Investors to explore:

- The evolving fixed income landscape

- Implications from recent market developments, and

- Methods for investors seeking to adapt their strategies

The Basics: Why Fixed Income Still Matters

Fixed income investments, also known as bonds, such as government and corporate bonds, are fundamentally different from equities. While stocks represent ownership in a company and offer potentially unlimited upside (and downside), bonds are a form of lending: you give your money to an issuer in exchange for regular interest payments and the promise of your principal back at maturity.

The primary roles of Fixed Income in a portfolio include:

- Predictable Income: Bonds offer regular, predetermined coupon payments, which are especially valuable for retirees or anyone seeking steady cash flow.

- Capital Preservation: High-quality bonds, particularly those issued by stable governments, offer a high degree of safety if held to maturity, since these entities are unlikely to default on their debt payments.

- Diversification: Traditionally, bonds have behaved differently from equities, often rising in value during periods of stock market stress, thereby reducing overall portfolio volatility.

- Liquidity: Many fixed income securities are highly liquid, allowing investors to buy and sell them with relative ease.

- Variety: Investors can tailor risk and return by choosing among different types, such as GICs (Guaranteed Investment Certificates), government bonds, corporate bonds, and various global strategies.

(For a detailed exploration of bond fundamentals, including how pricing works and key concepts like duration, see our companion article Understanding Bond Investing: A Foundation for Investors.)

Bonds vs. Stocks: A Fundamental Difference

Though grouped together as "investments," stocks and bonds play dramatically different roles in your portfolio. In a company’s capital structure, bondholders stand as creditors with legal claims to interest payments and principal, while stockholders are last in line for company profits. This distinction often proves valuable during market downturns or periods of economic uncertainty, as bonds typically offer stability when equities falter.

The Changing Landscape: Fixed Income in a New Era

The End of the Low-Rate Regime

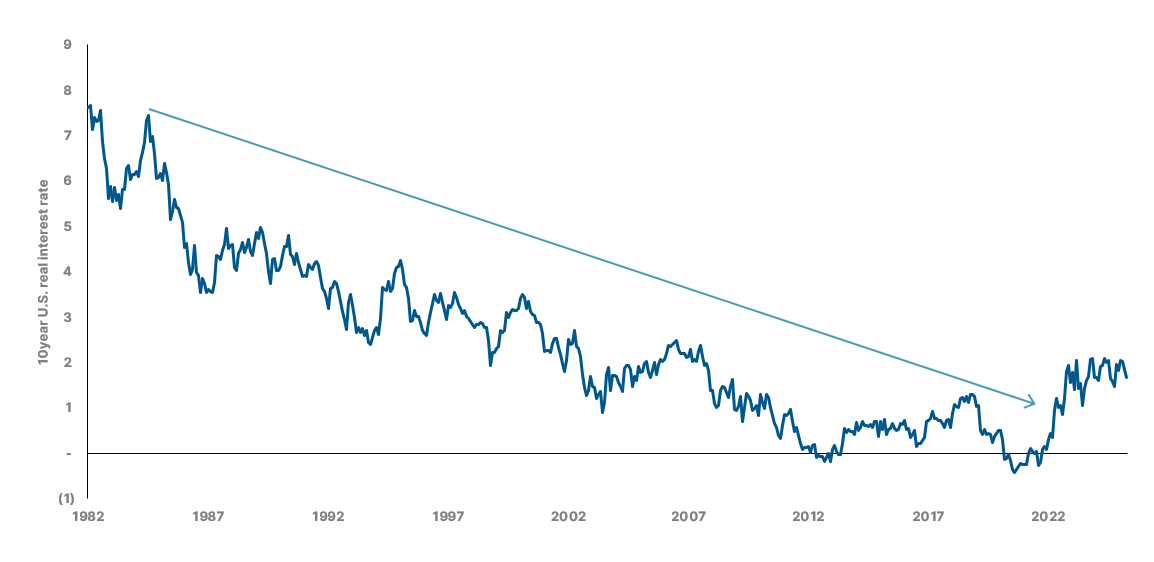

As shown in Chart 1, for over two decades, investors navigated historically low (and sometimes negative) interest rates, which suppressed bond yields and complicated income generation. This era ended abruptly in 2021–2022, as central banks aggressively hiked interest rates to combat inflation. Bond yields surged to decade highs, and existing bonds plummeted in value, causing significant losses for traditional portfolios.